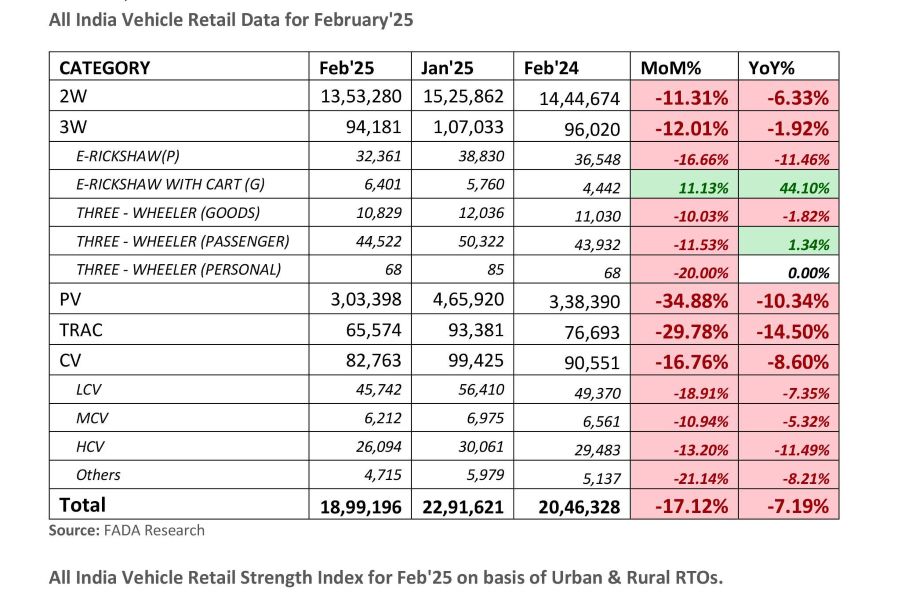

The Federation of Automobile Dealers Associations (FADA) has released its vehicle retail data for February 2025, reporting a 7% year-on-year decline across all segments. Dealers voiced concerns over rising unsold inventory, while a mix of festive optimism and segment-specific trends shapes expectations for March. Inventory imbalances, subdued consumer sentiment, and market fluctuations were key factors behind the decline.

FADA President C.S. Vigneshwar commented, “February saw a broad-based downturn across all categories, in line with our earlier projections of a ‘Flat to De-growth’ trend. Dealers highlighted a tough commercial landscape, with weak transportation sector sales, stricter financing norms, and pricing pressures delaying customer decisions—especially for bulk orders and institutional contracts. However, there is cautious optimism that March could see improvements as dealers adjust targets to align with evolving demand.”

Two-wheeler: Two-wheeler retail sales experienced a 6.33% Y-o-Y decline in February, despite an 8.57% growth in the fiscal year to date. According to the report, urban areas reported a 7.38% decline, while rural markets witnessed a 5.5% dip during the period under review. Dealers pointed to inventory imbalances, pricing adjustments post-OBD-2B implementation, weak consumer sentiment, and limited financing options as key challenges.

Passenger vehicle: Passenger vehicle retail sales fell 10.34% Y-o-Y in February, contrasting with a 4% fiscal year-to-date growth. Demand for entry-level vehicles remained weak, with dealers reporting difficulties in converting leads and meeting targets. Inventory levels reached 50–52 days, highlighting the need for better alignment between wholesale targets and actual retail demand.

Commercial vehicles: Commercial vehicle retail sales saw an 8.6% Y-o-Y drop in February, adding to a -0.5% fiscal year-to-date decline. Dealers cited weak sales in the transportation sector, tighter financing norms, and pricing pressures affecting bulk orders and institutional contracts. However, tipper bookings remained strong due to government spending and consistent supplies. Cautious optimism remains for March as dealers adjust their targets based on current demand.

March outlook: Dealer expectations for March 2025 are cautiously optimistic, with nearly 45% predicting growth, 40% foreseeing flat performance and 14% anticipating de-growth. Five consecutive months of declining stock markets have negatively impacted consumer confidence and discretionary spending.

Multiple festivals (Holi, Gudi Padwa, Navratri) and year-end depreciation benefits could lift retail sentiment across 2W, PV and CV segments.

Positive agricultural output and festive demand are expected to offset the recent decline in two-wheeler inquiries. Passenger vehicle sales are anticipated to benefit from promotional schemes, preponed festival sales, and year-end incentives. Increased government spending and institutional buying are likely to bolster commercial vehicle volumes, despite ongoing liquidity challenges.