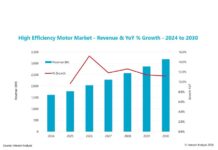

The Federation of Automobile Dealers Associations (FADA), India’s premier national body for automobile retail, announced the results of the Dealer Satisfaction Study 2025 at a grand award ceremony during the 7th Auto Retail Conclave on 10th September. This annual study is conducted in partnership with PremonAsia, a Singapore-based consumer insight and advisory firm.

Commenting on the study’s release, FADA President Mr. C S Vigneshwar said, “The Dealer Satisfaction Study (DSS) offers an accurate reflection of the evolving relationship between dealers and OEMs. This year’s study gathered feedback from over 1,800 dealer principals representing nearly 5,000 outlets nationwide. For the first time, it was conducted in nine regional languages to encourage broader and deeper participation. I sincerely thank the dealer community for their valuable time and insights.”

The message from the ground is clear. While our industry continues to win on product quality and reliability, structural issues like buyback policies, training costs, and dealership viability cannot be overlooked. Dealers are strongly voicing the need for fairer margins, greater policy flexibility, and more meaningful engagement in OEM decision-making at national, regional, and zonal levels. Post the Government’s GST relief, addressing these challenges assumes even greater urgency, as we collectively gear up for what promises to be a busy festive season ahead.”

In the fifth edition of the Dealer Satisfaction Study (DSS), PremonAsia Director and COO Mr. Rahul Sharma highlighted that while product quality remains the strongest driver of dealer satisfaction, after-sales service and business viability factors now influence nearly two-thirds of overall dealer sentiment. He emphasized that addressing issues like inventory costs, buyback policies, and training arrangements is essential to boosting dealer confidence and fostering long-term OEM-dealer partnerships.

In terms of performance, JSW MG retained its top position in the 4W Mass Market category with a leading score of 868 points. In the 2W segment, Royal Enfield led with 852 points, closely followed by Hero MotoCorp—both showing significant year-on-year improvement. Ashok Leyland continued its leadership in the Commercial Vehicle segment with 786 points, while Tata Motors CV also recorded notable gains.

FADA DSS 2025 Key Highlights:

- 3W Segment Returns: After a 3-year gap, Atul Auto leads with a top score of 924.

- 4W Luxury Leader: Volvo Cars tops with 884 points.

- Major Improvements:

- Royal Enfield & Hero MotoCorp see largest YoY gains (+140+ points each).

- Renault India rises +90 points, moving up in 4W mass.

- Tata Motors CVD is the only CV OEM to improve over last year.

- Overall Industry Average Score: 781, up by 13 points YoY.

- Top-Rated Factor: Product quality and range.

- Most Critical Issues:

- After-Sales Service

- Business Viability & Policy

Despite progress, dealer viability remains a major concern, especially around:

- Inventory buyback/write-offs

- Training cost-sharing

- Vehicle & spare part margins

- Long-term sustainability

FADA DSS 2025 Segment-Wise Summary:

- 2-Wheeler Segment:

- Improved dealer satisfaction over last year.

- Positives: Strong product range, frequent updates, effective training, and fair warranty claim handling.

- Challenges: Issues with inventory buyback/write-off, training cost-sharing, multi-brand outlet policies, and low margins. OEMs perceived as less receptive to dealer feedback.

- 4-Wheeler Mass Market:

- Decline in dealer satisfaction.

- Positives: Reliable products, wide customer choice, effective sales training, and fair warranty policies.

- Challenges: Inventory write-off/buyback, training cost-sharing, complex cost structures, and pressure from inventory carrying norms.

- Commercial Vehicle Segment:

- Decline in satisfaction.

- Positives: Product reliability, variety, timely updates, fair allocation, and order fulfillment.

- Challenges: Training cost burdens, low margins, VOR-related concerns, and overall dealership profitability.

Common Issues Across Segments:

Dealer viability, inventory-related policies, training cost-sharing, and low margins continue to affect long-term profitability.

2- Wheeler Market Segment

4-Wheeler Mass Market Segment Rankings

Commercial Vehicles Segment