Reflecting on the November 2025 auto retail performance, FADA President C. S. Vigneshwar noted that the industry defied the typical post-festive slowdown and delivered a resilient month despite facing a significantly high comparison base.

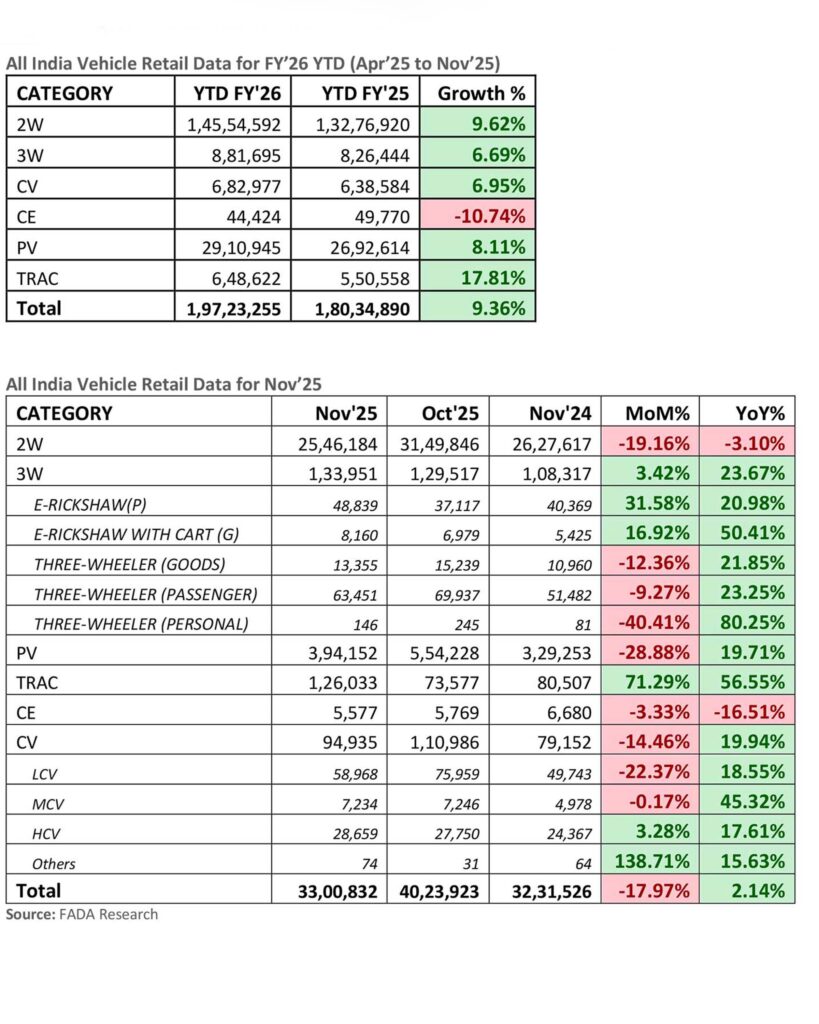

Unlike November 2024, when Deepawali and Dhanteras fell late and boosted registrations, most festive deliveries in 2025 were completed by October, shifting a substantial portion of retail activity forward. Even with this shift, the auto retail market closed November with a YoY growth of 2.14%, reaffirming strong consumer confidence and the structural stability of India’s mobility ecosystem.

GST 2.0 rate cuts, coupled with attractive OEM–Dealer offers, helped sustain showroom footfalls and supported conversions well beyond the festive period. The price reductions across segments that energised October retail continued to drive demand throughout November.

Segment Performance Insights

Two-Wheelers (2W)

The segment posted a modest 3.1% YoY decline, largely due to the retail shift to October, delayed crop payments, and uneven availability of preferred models.

Despite this, dealers reported strong walk-ins, driven by GST-led affordability, rising rural interest, and healthy marriage-season demand.

Passenger Vehicles (PV)

PV retail grew a strong 19.7% YoY, supported by:

- GST advantages

- Marriage-season buying

- Improved supply of high-waiting models

- Continued demand for compact SUVs

PV inventory reduced sharply to 44–46 days (vs. 53–55 days), reflecting much better demand-supply discipline.

Commercial Vehicles (CV)

CV retail rose 19.94% YoY, fuelled by:

- Infrastructure activity

- Goods movement

- Tourism mobility

- Government tender cycles

- GST reforms

However, fleet utilisation remained uneven in select regional pockets.

Near-Term Outlook: Rural Strength Driving the Momentum

The outlook for December 2025 remains positive, underpinned by strong rural fundamentals:

- Rabi sowing has crossed 39.3 million hectares, far ahead of last year.

- Higher acreage in wheat, pulses, and oilseeds signals improving farm-income visibility.

- The IMD forecast of a colder-than-normal winter is expected to boost mobility and logistics demand.

Dealers are reporting:

- Strong enquiry pipelines

- Better stock availability

- Improved rural liquidity from crop realisation

- Robust marriage-season demand

Year-end schemes, expected January price hikes, and stock liquidation efforts are likely to support continued retail traction.

Overall, the industry sentiment for December remains “cautiously optimistic”, driven by the GST-led affordability shift and two consecutive months of strong retail performance.

Early 2026 Outlook: Robust, Broad-Based Confidence Across Segments

Heading into 2026, the sector expects:

- Strong conversion rates from January price revisions, new 2026 model launches, and marriage-season demand

- Better liquidity from crop realisations in rural markets

- Continued support from government initiatives such as One Nation, One Tax and Viksit Bharat 2047, enabling broader vehicle penetration

While a natural moderation may occur in Jan–Feb due to model-year change sentiment and absence of festive triggers, the overall trajectory remains steady, backed by strong macro fundamentals and improving rural income visibility.

India’s auto retail ecosystem enters 2026 with cautious yet robust optimism, poised for a more resilient, inclusive, and future-ready mobility landscape.

Key Findings from FADA’s Online Members Survey

FADA’s latest online members survey reflects a stable and optimistic outlook across India’s auto retail network. Liquidity remains healthy, with a combined 91% of dealers reporting either ‘good’ or ‘neutral’ cash flow. Market sentiment is similarly positive, as 54.29% of respondents rate current conditions as good. Looking ahead, 63.93% of dealers expect retail growth in December 2025, while only 5.71% foresee any decline. The medium-term outlook is even stronger, with 74.29% of dealers anticipating growth over the next three months—signalling broad-based confidence, improving fundamentals, and steady demand momentum across segments.