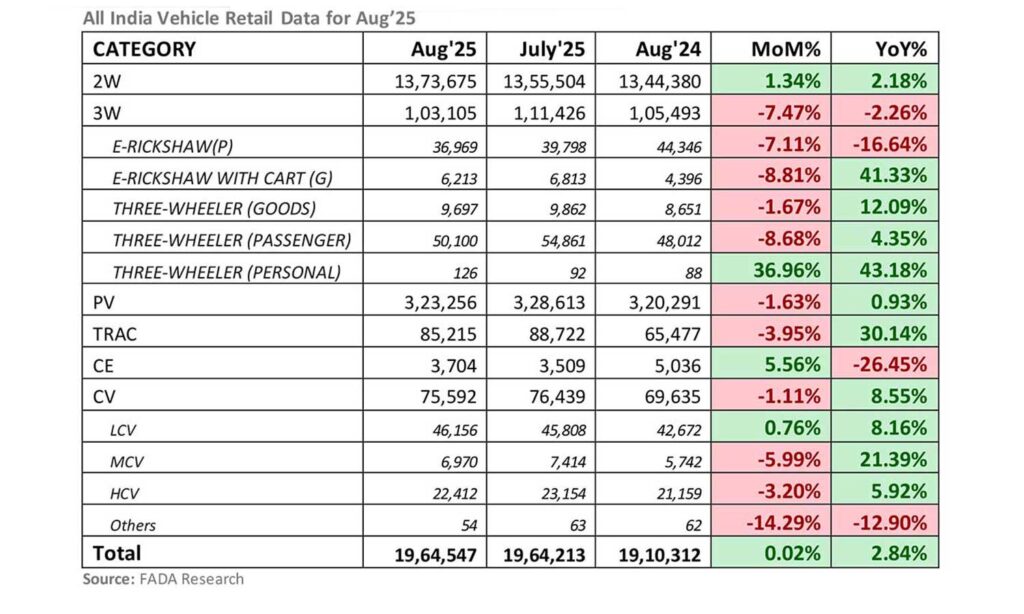

Vehicle retail sales in India rose by a modest 2.84% year-on-year (YoY) in August 2025, driven by growth in two-wheelers, passenger vehicles, and commercial vehicles, according to the Federation of Automobile Dealers Associations (FADA). However, the rollout of GST 2.0 led many customers to postpone purchases in anticipation of lower rates in September.

Segment-wise Performance:

- Two-wheeler sales increased by 2.18% YoY

- Passenger vehicles saw a marginal rise of 0.93%

- Commercial vehicle sales grew 8.55%

- Tractor sales surged by an impressive 30.14%

- Three-wheeler sales declined 2.26%

- Construction equipment sales dropped sharply by 26.45%

Despite strong buyer interest, passenger vehicle inventory levels remained high at around 56 days, as many customers delayed final purchases to benefit from upcoming tax changes. Additionally, heavy rains and supply chain disruptions impacted overall momentum.

FADA President C.S. Vigneshwar stated that GST 2.0 represents a historic, people-centric reform, introducing a simplified tax regime with just two slabs and a special rate for select categories. He noted that the announcement has boosted consumer confidence, with many families choosing to postpone purchases until September. “This isn’t a drop in demand, but a strategic deferment. We anticipate a strong surge in deliveries and conversions during the festive season,” he said.

Impact on Sales:

The revised GST structure—set to take effect from September 22—reduces rates to 18% or lower on small cars, two-wheelers up to 350cc, tractors, and commercial vehicles, while maintaining a 40% rate on premium models. In anticipation, dealers and OEMs have begun offering price benefits aligned with the upcoming cuts to drive early bookings ahead of Navratri and Durga Puja.

Near-Term Outlook

India enters September 2025 with strong economic fundamentals—GDP growth projected at 6.3–6.8% and inflation at a multi-year low of 1.55%. The rollout of GST 2.0 on September 22 is expected to lower household costs, boost consumption, and enhance industry competitiveness, potentially reducing inflation by up to 1.1 percentage points. A strong monsoon has further improved rural liquidity.

For the auto retail sector, September is expected to unfold in two phases: a slow first half due to Shraddh and the wait for GST implementation, followed by a sharp pickup driven by festive demand, policy clarity, and OEM schemes aligned with the upcoming tax cuts. These schemes allow early bookings with GST-adjusted prices, ensuring timely deliveries during Navratri and Durga Puja.

FADA is confident that September will kick off a new growth cycle for auto retail, supported by GST reforms, festive momentum, and proactive industry strategies.