There has been a 3% Month-on-Month (MoM) growth in the retail sales of all segments of the automobile industry, except tractors, which declined by 19%, in August 2023. Compared to pre-COVID levels, there was a modest 0.8% improvement, led by two-wheelers in the month, Manish Raj Singhania, President, Federation of Automobile Dealers Association (FADA), said.

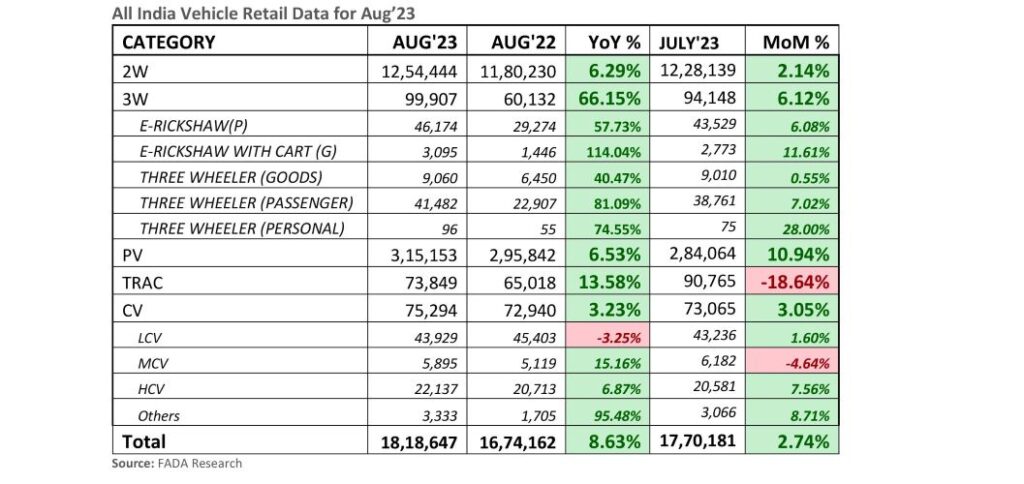

Singhania mentioned a 9% YoY growth, with a 3% MoM uptick, indicating a shift in short-term trends. Across segments, YoY growth was observed: 2W at 6%, 3W at 66%, PV at 6.5%, Trac at 14%, and CV at 3%. Three-wheeler sales reached a historic high, with 99,907 units sold in August, up 66% YoY and 6% MoM. The 2W segment displayed mixed results, with consumer sentiment impacting conversion rates and competition among key players.

The CV sector faced challenges but saw strong demand in sectors like cement, iron ore, and coal. The festive season is expected to lift the market, with aggressive promotions and improved customer sentiment, FADA said.

In the PV segment, positive market dynamics were maintained, but supply chain bottlenecks persisted, particularly in timely deliveries. The market has responded favourably to the introduction of new hybrid and CNG models; however, a constrained product range in popular segments, such as mid-size SUVs, continues to limit overall potential. As September begins, the Indian automobile industry is cautiously optimistic, driven by factors varying across vehicle segments. The festive season has improved market sentiments and supply chain conditions.

In the 2W market, while a broader range of models is now available, subdued rural demand due to insufficient rainfall could temper sales growth. For CVs, although bulk deals and the favourable timing of the construction season in September add to the optimism, the real sales momentum is anticipated to pick up during the Navratri and Deepawali festival following the Shraadh period. The PV market sees positive signs but faces customer discount expectations and the Shraadh period’s impact.

Rural demand is recovering but depends on the monsoon’s final phase. A lack of rainfall could impact crops and consumer purchasing power during the festive season. Key findings from an online survey of members include average inventory levels for passenger vehicles and two-wheelers, as well as varying liquidity levels among respondents, FADA said.