The Federation of Automobile Dealers Associations (FADA) has released vehicle retail data for CY’25 and December 2025, highlighting a resilient close to the year supported by policy-led affordability, improving sentiment, and broad-based demand recovery across segments.

CY’25 Auto Retail Overview

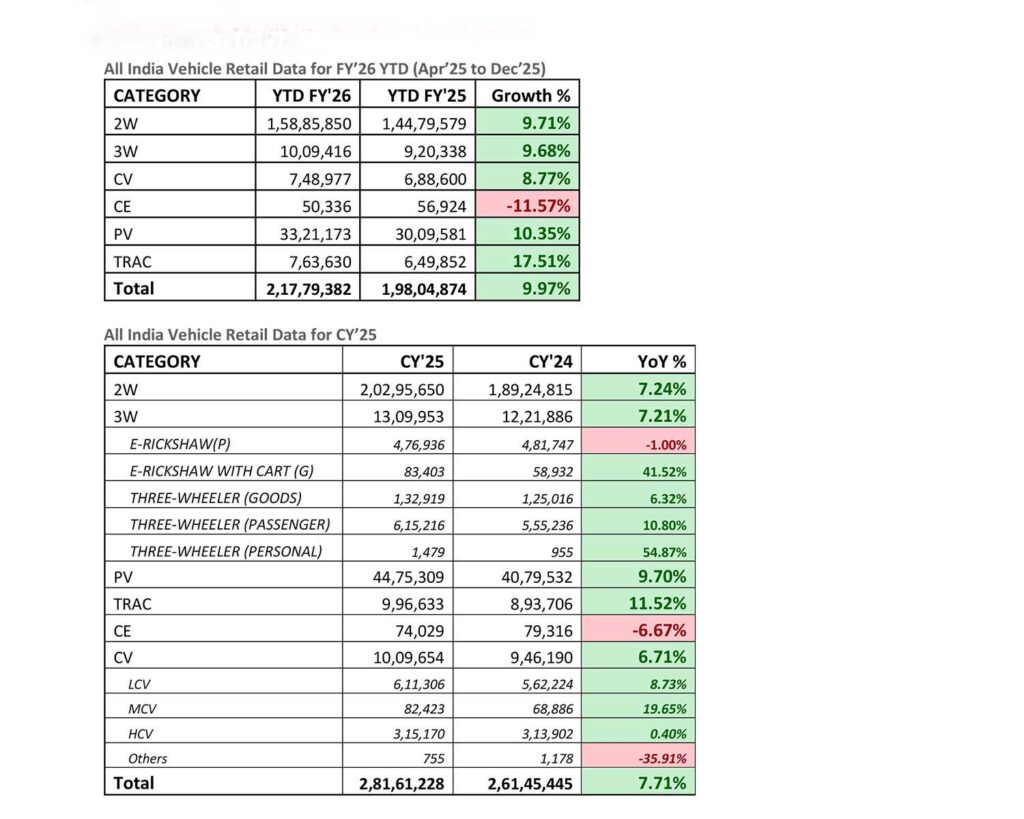

India’s auto retail market closed CY’25 at 28,161,228 units, registering a 7.71% year-on-year growth. However, the year played out in two distinct phases.

According to FADA President C S Vigneshwar, the January–August period remained muted despite supportive macro factors such as direct tax relief announced in the Union Budget and cumulative repo rate easing by the RBI. During this phase, consumers remained value-conscious and financing approvals were selective in several regions, resulting in uneven retail conversions.

A clear inflection emerged from September onwards, following GST 2.0 rate rationalisation, which reduced taxes across mass-market categories including small cars, two-wheelers (up to 350cc), three-wheelers, and key commercial vehicle segments. Improved affordability lifted sentiment, driving a sustained uptrend through September–December.

CY’25 Segment Performance

- Two-Wheelers: 20,295,650 units (+7.24%)

- Passenger Vehicles: 4,475,309 units (+9.70%)

- Commercial Vehicles: 1,009,654 units (+6.71%)

- Tractors: 996,633 units (+11.52%)

- Three-Wheelers: 1,309,953 units (+7.21%)

- Construction Equipment: 74,029 units (-6.67%)

Growth participation was broad-based, with urban retail up 8.20% and rural markets growing 7.31%. Within passenger vehicles, rural demand outperformed sharply, growing 12.31% compared to 8.08% in urban markets, underlining the widening reach of personal mobility beyond metros.

Powertrain Transition Accelerates in CY’25

CY’25 further reinforced the industry’s transition towards alternative powertrains:

- 3W EV share: 60.91%

- 2W EV share: 6.31%

- PV CNG share: 21.30% | PV EV share: 3.95%

- CV CNG share: 11.81% | CV EV share: 1.55%

The data points to a steadily diversifying mobility mix across segments.

December 2025 Auto Retail: Strong Year-End Finish

December 2025 delivered a robust close, with 2,028,821 vehicles retailed, marking a 14.63% YoY growth. FADA attributed the performance to sustained post-GST 2.0 sentiment, year-end offers, and pre-buying ahead of January price hikes.

December’25 Segment Performance

- Two-Wheelers: 1,316,891 units (+9.50%)

- Passenger Vehicles: 379,671 units (+26.64%)

- Commercial Vehicles: 83,666 units (+24.60%)

- Three-Wheelers: 127,772 units (+36.10%)

- Tractors: 115,001 units (+15.80%)

- Construction Equipment: 5,820 units (-18.54%)

Passenger vehicles remained a key growth driver, with rural PV growth at 32.40%, significantly outpacing urban growth of 22.93%. Dealers also used December to liquidate MY’25 inventory, supported by attractive schemes and improved model availability. PV inventory levels declined to 37–39 days, down by around seven days month-on-month.

December’25 Powertrain Mix

- 2W EV share: 7.40%

- 3W EV share: 69.12%

- PV: ~21% CNG | ~4% EV

- CV EV share: 2.35%

Near-Term Outlook: January 2026

Dealer sentiment remains constructive, with 70.48% of dealers expecting growth. January is expected to be two-paced—softer in the first half, followed by stronger traction post Makar Sankranti and Pongal, aided by the marriage season and ongoing enquiry pipelines. RBI’s December 2025 repo rate cut and improved system liquidity are expected to support borrowing sentiment.

Rural demand is likely to remain supportive, backed by robust rabi sowing progress and near-completion of the kharif harvest. However, OEM-announced price hikes could keep affordability sensitivity in focus. Faster finance approvals and timely allocation of in-demand models will be critical for conversions.

Outlook for JFM 2026

Looking ahead, the retail outlook remains upbeat, with 74.91% of dealers expecting growth over the next three months. Demand drivers include festival-led buying, the marriage season, and financial year-end purchases.

Rural tailwinds remain constructive, supported by favourable crop conditions and IMD’s forecast of a colder January, which benefits winter crops. On the macro front, the RBI’s repo rate at 5.25% and expectations of a consumption-supportive Union Budget could further lift discretionary demand. While OEM price revisions may sustain purchase urgency, disciplined inventory management and sharper finance turnaround times will remain key.