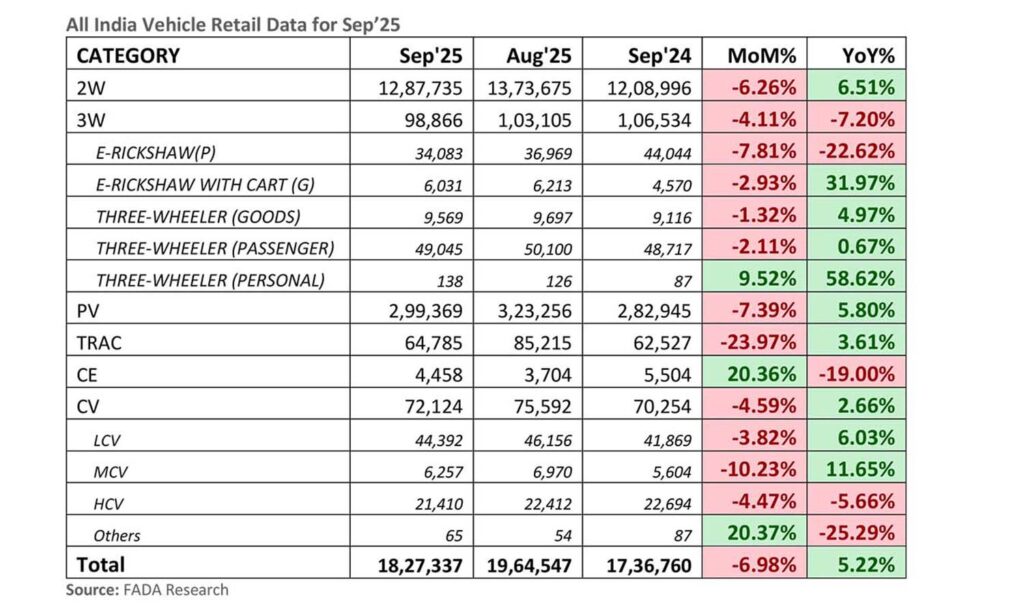

India’s vehicle retail sales grew by 5.22% year-on-year in September 2025, reaching 18,27,337 units compared to 17,36,760 units in September 2024, according to data released by the Federation of Automobile Dealers Associations (FADA) on Tuesday.

The growth came despite sluggish demand in the first three weeks of the month, largely due to anticipation around the rollout of GST 2.0. However, sales gained strong momentum following the launch of the new GST framework and the onset of the Navratri festival on September 22.

Segment-wise, two-wheeler (2W) sales rose 6.5%, totaling 12,87,735 units compared to 12,08,996 units in the same month last year. Passenger vehicle (PV) sales also saw a 5.8% increase, reaching 2,99,369 units in September 2025.

Heavy Vehicle Sales See Modest Growth in September, While 3-Wheelers and Construction Equipment Decline; Navratri 2025 Fuels Historic 34% Retail Surge

In September 2025, sales of heavy vehicles showed modest gains, with tractor (Trac) sales rising by 3.6% to 64,785 units and commercial vehicle (CV) sales increasing by 2.6% to 72,124 units. However, not all segments fared well—three-wheeler (3W) sales dropped 7.2% to 98,866 units, and construction equipment (CE) saw a steep decline of 19%, falling to 4,458 units.

Inventory levels for passenger vehicles rose to around 60 days, indicating that dealerships are well-stocked in preparation for the upcoming festive season.

Navratri 2025 Sparks Historic 34% YoY Retail Growth

The Navratri festival period (22nd September to 2nd October) delivered a record-breaking 34% year-on-year growth in retail vehicle sales. This surge, dubbed the “Bachat Utsav,” was powered by GST 2.0 benefits, attractive festive offers, and pent-up consumer demand across most vehicle categories.

Key Segments See Strong Growth During Navratri 2025, Except Construction Equipment

Most vehicle segments recorded significant growth during the Navratri 2025 period, driven by festive demand and positive market sentiment.

Two-wheelers saw a remarkable 36% increase, reaching 8,35,364 units, while three-wheeler sales jumped 24.5% to 46,204 units, fuelled by rising urban mobility needs. Passenger vehicles grew by 34.8% to 2,17,744 units, supported by increased affordability and a wave of upgrade purchases.

Commercial vehicles rose 14.8% to 33,856 units, reflecting continued optimism in infrastructure development. Tractor sales climbed 18.7% to 21,604 units, showing resilience despite challenges from an uneven monsoon.

However, construction equipment sales declined sharply by 18% to 2,163 units, as heavy rains disrupted construction activities across several regions.

Strong Festive Momentum Expected in October Amid Positive Economic Indicators

The upcoming October festive season is expected to deliver strong retail performance, driven by favourable economic conditions. Key factors such as above-normal monsoons, a healthy kharif harvest, and stable interest rates from the Reserve Bank of India (RBI) are boosting consumer purchasing power.

The Federation of Automobile Dealers Associations (FADA) anticipates that continued benefits from GST 2.0, aggressive promotional schemes by original equipment manufacturers (OEMs), and easy financing options will attract both first-time buyers and upgraders.

Sai Giridhar, Vice-President of FADA, described September 2025 as a uniquely pivotal month for India’s auto retail sector. “The first three weeks saw subdued activity as buyers waited for the GST 2.0 rollout. However, things changed significantly in the final week when Navratri festivities aligned with the implementation of reduced GST rates. This dual trigger revived consumer sentiment and accelerated deliveries across most vehicle categories. Dealers also took this opportunity to replenish inventory,” he noted.

The current upward momentum signals a robust festive season ahead, reflecting improved market sentiment and broader economic strength.