India’s auto industry produced 26.93 lakh units across all vehicle categories in August 2025, marking an 8.1% year-on-year growth. However, domestic sales trends varied across segments, with manufacturers moderating production in anticipation of potential GST reductions.

Passenger Vehicles Face Pressure

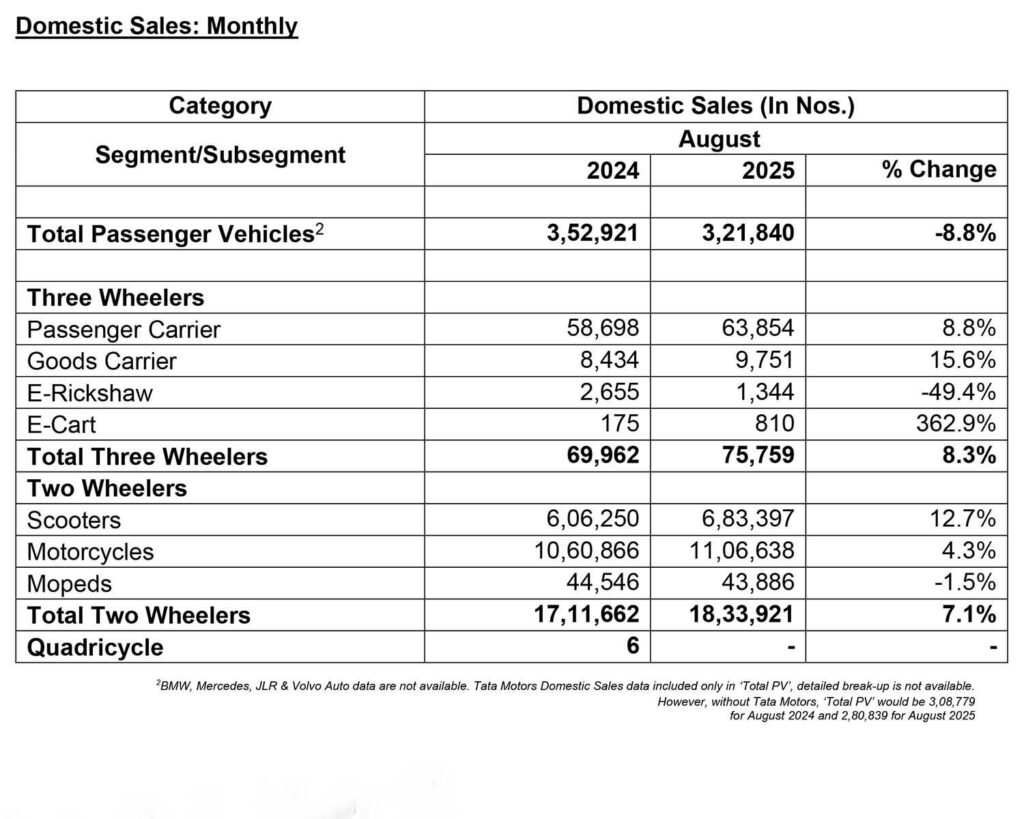

Passenger vehicle (PV) sales declined 8.8% to 3.22 lakh units, as OEMs recalibrated dispatches ahead of expected policy changes, according to SIAM Director General Rajesh Menon.

- Passenger car production dropped 7.9% to 1.25 lakh units

- Utility vehicles saw a modest 1.8% dip to 2.25 lakh units

Despite production setbacks, PV exports surged 24.6%, indicating strong international demand.

Two-Wheelers Lead Growth

The two-wheeler segment was a growth driver, with sales rising 7.1% to 18.34 lakh units.

- Scooters led with 12.7% growth to 6.83 lakh units

- Motorcycles followed, growing 4.3% to 11.07 lakh units

- Mopeds declined 1.5%, reflecting softness in the entry-level market

Three-Wheelers Hit Record High

Three-wheeler sales reached an all-time high for August, growing 8.3% to 76,759 units.

- Passenger carriers rose 8.8% to 63,854 units

- Goods carriers grew 15.6% to 9,751 units

- The electric 3W segment stood out, with e-carts surging 362.9% to 810 units, underscoring rising adoption for last-mile deliveries. However, e-rickshaw sales declined significantly by 49.4% to 1,344 units.

Commenting on the industry’s performance, SIAM Director General Rajesh Menon welcomed the government’s recent move to reduce GST on vehicles, calling it a potential game-changer. “The Government of India’s landmark decision to lower GST rates will significantly enhance mobility access and is expected to inject fresh momentum into the automotive sector, especially with the festive season around the corner,” he said.

Year-to-Date Performance (April–August 2025)

The Indian auto industry demonstrated resilience during the April–August 2025 period, with total production reaching 1.28 crore units, marking a 4.6% year-on-year growth. However, domestic sales dipped slightly by 0.8% to 99.80 lakh units, while exports surged by 25.3% to 25.37 lakh units, driven largely by strong performance in the two-wheeler segment, which recorded 26.2% growth in exports.

Performance across key players varied by segment. Maruti Suzuki retained its leadership in the passenger vehicle market despite facing production constraints. In the two-wheeler space, Hero MotoCorp and Honda continued to dominate, supported by strong brand equity and a broad product lineup. Bajaj Auto maintained a solid presence across both two-wheeler and three-wheeler segments, showcasing the strength of its diversified vehicle portfolio.