Due to improved production and anticipation of festive demand, vehicle dispatches were in green during November 2023. This year the festive season, which accounts for about 28% of the total annual sales of the industry, concluded in November as against the month of October during the last year.

Following is a segment wise report of vehicle dispatches during November 2023.

Passenger Vehicles: On a high base of last year, the domestic passenger vehicle wholesales stood at 3.35 lakh units in November 2023, marking a growth of about 4% over 3.22 lakh units in November 2022. SUVs contributed to about 53% of the total industry dispatches to dealers in November this year.

However, post the festivals of Diwali and Bhai Dooj which concluded by November 15, the industry has witnessed a drop in retail sales, said Shashank Srivastava, Senior Executive Officer- Marketing and Sales, Maruti Suzuki.

Most PV OEMs are expected to moderate their wholesales in December in order to manage the high stocks. While some models have a long waiting period, others are building up the inventory. Customers may also expect sales promotions both on OEM and dealer level before the yearend. According to Srivastava, the industry is expected to close the current financial year with the best-ever annual wholesales of over 41 lakh units.

In November 2023, Maruti Suzuki India Limited sold a total of 164,439 units. Total sales in the month include domestic sales of 136,667 units, sales to other OEM of 4,822 units and exports of 22,950 units.

Hyundai Motor India Ltd. (HMIL), registered total sales of 65,801 units in November 2023. Total sales for the month of November 2023 include domestic sales of 49,451units and export of 16,350units.

Hyundai Motor India COO Tarun Garg said, “Hyundai Motor India recorded cumulative sales of 65,801 units in November 2023. With encouraging customer response leading to higher retail sales during the festival season, our Dealer network stock is at a very optimum level of 3 weeks. As Hyundai family, we are well-prepared to end a very successful CY 23 on a high and welcome CY 24 on a positive note.”

He added, “Hyundai Motor India’s SUV line-up continues to exhibit robust momentum, contributing over 60% to our overall sales. Our latest addition to SUVs, Hyundai EXTER has achieved a major milestone of 1 lakh bookings. This is a testimony to customers appreciating Hyundai cars that offers top-notch quality, safety, technology and design. Hyundai Motor India remains committed to not only selling cars but also fulfilling aspirations of our beloved customers.”

Tata Motors Limited sales in the domestic & international market for November 2023 stood at 74,172 vehicles, compared to 75,478 units during November 2022.

Honda Cars India Ltd. (HCIL), registered monthly domestic sales of 8,730 units witnessing a growth of 24% over the same month last year. The export numbers for HCIL during Nov’23 were 3,161 units with a growth of over 335% growth. The company had registered 7,051 in domestic sales and exported 726 units in November’22.

Mr. Yuichi Murata, Director, Marketing and Sales, Honda Cars India Ltd said, “Our product line-up saw a good surge in demand throughout the festive period. Our new SUV Honda Elevate has been well received by the market with very high customer consideration. We are confident to carry forward this growth momentum for the rest of the year.”

MG Motor India has registered retail sales of 4,154 units in November 2023. EV sales continued to account for around 30 per cent of the total vehicles sold this month.

Mahindra & Mahindra’s overall auto sales for the month of November 2023 stood at 70,576 vehicles, a growth of 21%, including exports.

In the utility vehicles segment, Mahindra sold 39,981 vehicles in the domestic market, a growth of 32% and overall, 40,764 vehicles, including exports. The domestic sales for commercial vehicles stood at 22,211.

Veejay Nakra, President, Automotive Division, M&M said, “We continue our growth trend, backed by strong demand for our SUV portfolio. While we saw a healthy festive season, we faced supply challenges on select parts during the month. We are keeping a close watch and taking appropriate steps to mitigate the challenges”.

Interestingly, the industry’s hybrid vehicle sales surpassed that of electric vehicles (EVs) for the third consecutive month in November.

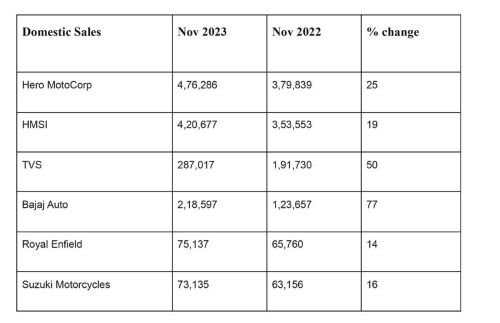

Two Wheelers: In anticipation of festive demand from rural and ongoing marriage season, two-wheeler makers reflected a positive trend in wholesales with all the OEMs marking a double-digit growth in November.

With a pickup in demand during the festive time, the industry remains optimistic for the upcoming months.

B. Govindarajan, CEO, Royal Enfield said, “With our recent launches we are confident that we will be able to sustain our growth momentum.”

Ratings agency ICRA recently stated that the industry is expected to record a moderate growth in volumes in FY 2024 (4-7%) even as export volumes remain impacted by weak demand.

During the festive season, there was a robust growth in two-wheeler retails (about 21% YoY), aided by festive cheer, upcoming marriage season and some recovery in rural demand, which supported sales growth in the entry level segment (<110 cc). The dealer inventory levels remained at near normal levels, with the OEMs wary of a build-up in inventory at the dealerships, it said.