The Federation of Automobile Dealers Associations (FADA), India’s premier organization for automobile retail, recently unveiled the results of its comprehensive Dealer Satisfaction Study 2023. Conducted in collaboration with Singapore-based PremonAsia, a leader in consumer insights and advisory services, the study offers an unparalleled look into the auto retail landscape.

Commenting on the release of the study, FADA President, Mr. Manish Raj Singhania said, “The YoY improvements underscore the indispensable value of this annual study in identifying critical issues to fortify the Auto OEM-Dealer partnership. While Auto Dealers are increasingly optimistic, concerns related to dealership viability and policy collaboration with OEMs require immediate attention. Going forward, high-impact areas such as unsold inventory clearance and actions against MBOs (Multi-Brand Outlets) offer ample scope for improvement.”

FADA Treasurer and Director DSS’23, Mr Amar Jatin Sheth added, “In its third edition, DSS’23 has grown more robust, drawing participation from over 1,800 Dealer Principals and approximately 3,500 outlets, representing a balanced mix from all four geographical zones in India. The study utilizes six evaluative dimensions and 70 attributes to arrive at its findings. While dealer satisfaction is generally improving, aspects like dealer involvement in OEM policy-making remain areas for potential progress.”

PremonAsia Director and COO, Mr Rahul Sharma remarked, “The Dealers continue to assign higher importance to After-sales and Business Viability related issues. While there have been improvements made by OEMs in all the areas, the expectations on ensuring Dealer viability, particularly related to OEMs buyback / deadstock inventory and understanding the dealer cost structure are still flagged as concern areas across the industry. Addressing these concerns through involving dealers in the policy making and hearing them will certainly go a long way in managing dealer expectations better.”

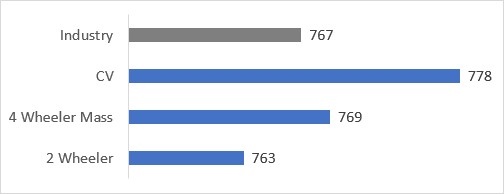

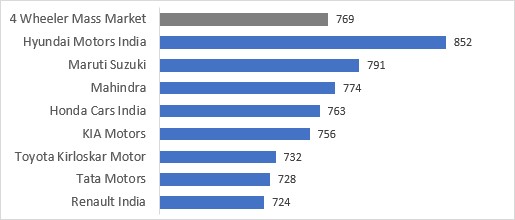

Commercial Vehicle (CV) dealers were the most satisfied with 778 points, followed by mass market four-wheeler (4W) dealers at 769 points and two-wheeler (2W) dealers with 763 points.

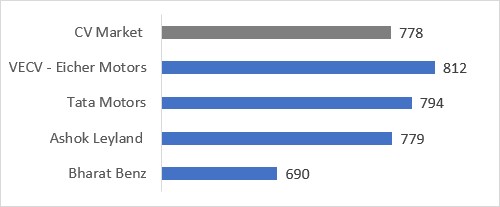

As per the FADA study, in the CV category, VECV Eicher Motors dealers had the highest level of satisfaction with the company scoring 812 points, followed by Tata Motors at 794 points and Ashok Leyland (779).

In the 4W mass market, Hyundai Motors India scored 852 points, followed by Maruti Suzuki (791) and Mahindra (774).

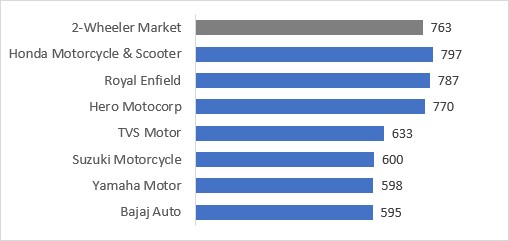

Honda Motorcycle & Scooter topped the charts in the 2W category with a score of 797, while Royal Enfield (787) and Hero MotoCorp (770) took the second and third spots, respectively.