The Federation of Automobile Dealers Associations (FADA) released Vehicle Retail Data for April 2023. The 2-wheeler segment continues to face challenges, with entry-level vehicles attracting fewer buyers. FADA urges the GST Council to consider reducing GST on 2-wheelers from 28% to 18% to help revive this vital segment, which represents 75% of total auto sales volume.

On the other hand, the upcoming marriage season in May is expected to bring about a sales resurgence, driven by an increase in customer inquiries. Additionally, as electric vehicles (EVs) gain popularity, customers are increasingly considering transitioning from internal combustion engines (ICE) to EVs, which may temporarily delay purchasing decisions.

The Commercial Vehicle (CV) segment is witnessing strong demand in the M&HCV segment, supported by robust infrastructure projects taking place nationwide. Improved product supply from OEMs and customer adaptation to price shifts contribute to the segment’s growth. In the Passenger Vehicle (PV) segment, rising inventory levels are raising concerns.

FADA urges OEMs to recalibrate their inventory and prioritize the production and supply of products that are in high demand, ensuring a more efficient alignment between market demand and available inventory. This will ultimately benefit both the customers and the manufacturers. Despite the ongoing chip shortages and somewhat sluggish market conditions, the marriage season in May is expected to provide a slight boost in sales for the current month.

Unfavorable weather conditions may persist in May, including untimely rains and hailstorms, causing crop damage in many states. This exacerbates concerns for farmers and may potentially impact entry-level 2-wheeler and passenger car sales.

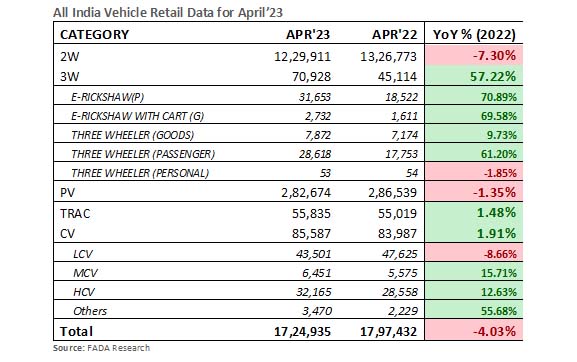

Commenting on April 2023’s performance, FADA President Mr. Manish Raj Singhania stated, “Financial Year 2024 began on a subdued note, with the month of April experiencing a 4% YoY overall decline. Although the 3-wheeler segment enjoyed robust growth of 57% YoY, Tractor and CV segments only grew by a modest 1% and 2%, respectively. Meanwhile, the 2-wheeler and Passenger Vehicle categories experienced YoY degrowth of 7% and 1%, respectively.”