In a recently revised global manufacturing outlook, Interact Analysis, a renowned global market intelligence firm, offers a comprehensive glimpse into the intricate economic landscape that awaits the manufacturing industry. The report paints a picture of a challenging global manufacturing landscape, a scenario that is anticipated to persist through the year 2024 and into the early months of 2025.

The economic pressures and growth prospects vary across different regions, shedding light on the distinct trajectories of manufacturing across the world.

Europe: Challenges and Resilience

Europe finds itself grappling with significant economic challenges. The outlook here may seem bleak, but a glimmer of hope emerges from the automotive sector. Notably, countries like Germany and France are witnessing the automotive industry’s resilient performance. Italy, on the other hand, is poised to experience a 2% growth in production output in 2023. This growth can be attributed to the automotive, transportation, and rubber & plastic sectors, which are driving the region’s manufacturing landscape. Surprisingly, the UK has surpassed expectations, with its output expected to have grown by 0.2% in 2023. This stands in contrast to the negative growth forecasted in the previous edition of Interact Analysis’s report.

Americas: Machinery Production’s Triumph

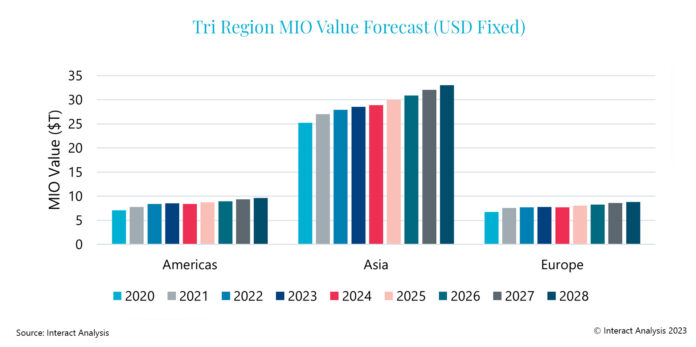

The Americas, in contrast, exhibit a unique story. While the region weathered the initial half of 2023 with a semblance of stability, machinery production is expected to outpace the broader manufacturing sector between 2023 and 2028. This sub-sector’s Compound Annual Growth Rate (CAGR) is forecasted at 3.8%, outstripping the manufacturing production’s 2.4%. Yet, the region’s economic outlook is intricately tied to the actions of the Federal Reserve. If interest rates decrease at a sluggish pace, 2024 may be a bleak year. However, if rates increase too rapidly, inflation might soar, leading to a challenging period of economic stagflation.

Asia: Semiconductor Slump Impact

Asia, a significant player in the global manufacturing landscape, has faced its share of challenges. The semiconductor slump has taken a toll on manufacturing output in the Asia Pacific region, which accounts for nearly 90% of semiconductor and components production. This downturn has been a notable factor in the region’s declining manufacturing output. In terms of growth, machinery production and manufacturing as a whole are projected to evolve at different rates. In Asia, machinery production is anticipated to grow at a CAGR of 3.9%, while manufacturing production is forecasted at 2.9%. In Europe, these figures stand at 3.6% and 2.4% respectively. However, 2024 is expected to bring negative growth for machinery production, followed by a return to positive figures in 2025, maintaining a trajectory of sustained growth through 2028.

United States: Semiconductor Stability and Economic Challenges

The United States tells an intriguing tale in the global manufacturing narrative. While its semiconductor segment is performing relatively well compared to other countries, it is expected to become the epicenter of the next global manufacturing recession in 2024. The semiconductor segment, which has struggled in Taiwan and South Korea with a projected shrinkage of over 20% in 2023, demonstrates stability in the US.

The future economic prospects in the US hinge significantly on the Federal Reserve’s response to the unfolding scenarios. If interest rates decrease at a languid pace, 2024 may indeed be a challenging year. Conversely, if rates are raised too rapidly, the nation may witness an inflation surge, ushering in a period of economic stagflation.

China: Stimulus Policies and Economic Momentum

China, the world’s manufacturing powerhouse, is navigating its economic path with the help of stimulus policies. These policies appear to be making a positive impact on the country’s manufacturing growth. The second half of 2023 saw China gaining momentum after a sluggish start to the year. The full effects of these government policies on the economy are yet to be fully realized, despite some encouraging signs emerging in August of the same year.

Interact Analysis has revised China’s manufacturing output forecast down by 0.2 percentage points to 3.2% for 2023. However, the outlook for the region in 2024 has been revised upward from 2.9% to 3%. The predicted Compound Annual Growth Rate (CAGR) for China’s manufacturing sector between 2022 and 2027 stands at approximately 3.2%.

The Optimistic Perspective

Adrian Lloyd, CEO at Interact Analysis, shares an optimistic view of the global manufacturing landscape. He notes that the global manufacturing economy is beginning to witness signs of stability. While 2024 may present its share of challenges, it’s encouraging to see certain regions experiencing growth, particularly China and the United States. Notably, the automotive sector appears to be performing well across regions, even in Europe, which is still grappling with economic storms.

Looking ahead, Interact Analysis anticipates a period of significant resurgence in the global economy. This resurgence is expected to usher in sustained growth that will span until 2028, encompassing all corners of the globe.